Sunday, April 29, 2012

The "Bubble" and What's Really Going on with Startups

I think the article is about 1/3 correct and 2/3 nuts. Yes, some startup valuations do seem amazingly high. No, there isn't some grand conspiracy, and there isn't necessarily a bubble.

This is an important issue for the mobile tech world because mobile startups are a huge part of the so-called bubble. If you're working in a mobile startup, or thinking about doing one, you need to understand what's happening. Here's my take:

I've spent more than a year pitching the startup I'm working in, Zekira, to VCs and angels in Silicon Valley. I've met with scores of them, taken them to breakfast and coffee, and had long philosophical conversations with them about our company in particular and startups in general. I have friends and former co-workers who now work in the VC and angel world. I've also spent a huge amount of time networking with other entrepreneurs, successful and otherwise, and the conversation always turns to the fund-raising process. So while I don't claim to be the world's greatest expert on startup funding, I do have a pretty good ringside seat. Here's my list of venture funding myths and realities as they relate to the Times article:

Myth 1. Venture capitalists and angels are in the business of creating new technology products. Not true, and in this respect the article is right. Many people who work as VCs and angels are passionate about technology and love to be personally involved with new tech products. They give great, enthusiastic advice. But their business is to create companies they can sell. Period. They don't get paid until a company either gets acquired or goes public, so their focus is on creating companies that they can sell to someone for a markup.

There's nothing new about this. Venture capital has always worked this way.

Myth 2. We are in another tech bubble "worse" than 1999 (in the words of the article). In the late 1990s, valuations of all tech companies, startups and otherwise, were wildly over-optimistic. This situation made it easy for VCs to take new tech companies public at a much earlier stage, and at a higher value, than was possible previously. As one VC explained to me at the time, "there's market demand for companies that are much less mature than those we launched in the past, so we're going to fulfill that demand."

Because the entire stock market was involved, and because immature companies were offered in IPOs, the retirement fund of every American was put at risk. That's not the situation today. The market valuations of existing tech companies are not wildly out of whack (a point made well here). The startups being sold without revenue are almost all being peddled to other tech companies, not to the public. Facebook and Google and some other big firms have decided that they need to buy consumer internet and mobile companies with rapidly growing audiences. Competition between them has driven up the valuation of those companies.

Are the valuations inappropriate? I don't know, but Facebook and Google and the rest are big and successful and presumably know what they're doing. They can also afford to lose the money they're spending. So even if there is a bubble, at this point I don't think is is even remotely the sort of economic threat it was in the late 1990s.

As for the VCs' role in this, they're just doing what they always do, fulfilling the demand for a particular type of company.

Myth 3. Startups are being told not to make revenue because that will disrupt their valuations.

Oh, please.

The reality is that there are at least two tracks of startup activity, which I will label trendy and traditional. The trendy startups are web and mobile services hoping to be acquired by the big web players. For those companies, the source of their valuation is the number of users they attract and the rate at which they grow. Revenue is irrelevant because Facebook and friends aren't buying revenue, they are buying market position.

In a trendy startup, making revenue is a problem because it distracts you from the goal of growing the audience. The VCs are right to tell companies to disregard it.

But the traditional startups are treated very differently. In those companies, the VCs are looking for a strong team, good product, and proven revenue. In fact, the problem is not that companies are being told not to make revenue, it's that even angels are often demanding that companies have a customer base and substantial revenue streams before they'll make an investment. In other words, the investors don't act like the stereotype of early-stage people who fund a cool idea, they act more like banks.

From my perspective, it looks like most of the big VCs are investing in a mix of trendy and traditional startups. Among the angels there seem to be different circles, some specializing in trendy startups and some specializing in traditional ones. But the trendy startup scene gets almost all the public attention. It's what drives the startup weblogs, it drives the big drinking parties, it brings people out to the conferences, and it generates most of the press coverage for spectacular acquisitions.

You often see news articles focus on the trendy startups as if they're the only thing happening in venture capital. That's exactly what the Times article did.

The trendy startup scene is entertainment, spending a weekend in Vegas without the long drive across the desert. Like gambling, the attraction of trendy startups is that you might get wildly rich for a small investment of money and time. Also like gambling, you'll probably lose your shirt.

Is that a bad thing? Only if you bet money and time that you can't afford to lose.

The danger to the public (and to the economy as a whole) will be if and when trendy startups start to be offered up in IPOs. If that happens, it will be very important for all of us, the New York Times included, to raise an alarm very loudly. But that's not the situation we're in today. Calling today's situation a bubble is crying wolf, because it may cause people not to pay attention when there really is a problem in the future.

Thursday, April 26, 2012

Apple is Not Sony

The longer I've been in the tech industry, the more I've come to realize that predictions about it are usually worthless.

Leave aside the big failed dreams like nuclear-powered aircraft (link) and the transatlantic train tunnel (link). Even products that seem relatively straightforward can be very hard to predict. The industry thought tablets and e-books were imminent for at least a decade before someone got them right, and we're still waiting for micro fuel cells and flexible screens.

There are so many moving parts in the industry, and success depends on so many tiny details of execution, that it's basically impossible to predict even things that look, in retrospect, like they were inevitable.

If it's that hard to predict the fate of individual technologies that have been studied for decades, imagine the difficulty of predicting the fate of an entire company made up of thousands of people and numerous product lines. What you can do is predict what could happen, and even take a guess at the odds. We've all been collectively doing that lately with RIM and Nokia. But even to make that kind of prediction you need to look at companies' management, products, customer base, financial status, and technologies, plus do an assessment of its competitors. Forrester did none of that for Apple. Instead it drew a simple little equation, based on sociological theory: Apple was led by a charismatic founder, as was Sony. After Sony lost its charismatic founder, the company declined. Apple has now lost its charismatic founder, so it'll decline too.

Forrester is an excellent research firm, and I have huge respect for its quantitative market research. But in this case I'm not buying its prediction, for a couple of reasons:

First, although it's accurate to say that Sony declined after the loss of Akio Morita, it's not clear that the company's decline was caused solely or even primarily by the loss of Morita. Here's a chart from Yahoo Finance of Sony's stock price since 1985:

The red arrow marks 1994, the year when Morita stepped down after suffering a stroke. Ignore the ridiculous spike in the middle caused by the Japanese economic bubble; the important point is that at its peak in 2007, 13 years after Morita left the company, Sony's stock price was double what it was when he left. The PlayStation, Sony's most vibrant tech product today, was started under Morita but is generally credited to Ken Kutaragi and his sponsor Norio Ohga, the man who succeeded Morita.

I have no doubt at all that Akio Morita was central to the building of Sony. But I think its decline stems from a lot more than just his departure.

In a similar vein, I am not at all persuaded that the success of Apple under Steve Jobs can be credited entirely to his presence. I worked there for almost all the time he was gone, and Apple without Steve had a lot of strengths -- a strong engineering team, a strong product management culture, great industrial designers and artists and marketing gurus, and a beloved brand with fanatical users. What the company didn't have, I think, was leadership capable of making all those strengths mesh. Some of Apple's work was wonderful (the Macintosh II and the PowerBook computers come to mind), and some of it was completely forgettable. Management was not able to get the company consistently united around a single set of long-term goals. Instead the company lurched from initiative to initiative, some of them pushed by outside consultants, many underfunded or contradictory. Apple's culture of passive resistance, created in part by Steve Jobs himself during his first time at the company, made the problems worse.

What Jobs brought to Apple when he returned, more than anything else, was focus. He committed Apple to a relatively narrow set of initiatives, and made sure everyone in the company got behind them. That let Apple's existing strengths shine through to the market. Jobs was able to rescue Apple because it was only partially broken.

Forrester's article depicts Apple under Jobs as a company of followers who waited to be given their marching orders from on high. That theory sounds reasonable if you don't know anyone who works at Apple, but I do. The folks I know there are team players, but by no means are they passive followers. I think the real risk is not that Apple without Jobs will drift, but that it may revert to its old bad habits. Will the company's management team continue to work together, or will it fall into passive resistance? Can Tim Cook enforce discipline without alienating the big talents (and big egos) scattered throughout the company? Do the managers themselves recognize the need to cooperate in order to keep Apple on top?

Forrester can't know the answer to that question. Neither do I. Yes, at some point Apple will decline; nothing lasts forever. But unless somebody develops the ability to read minds, we can't predict when Apple will come apart. And in the tech industry, if you don't know when, you don't know anything.

Tuesday, April 17, 2012

Jenesse Silver Rose Gala 2012 & Halle Berry Golf Tournament

|

| Actress Halle Berry, Chairperson of the Jenesse Center's Gala Event |

|

| Ghanaian Actress Nadia Buari |

|

| Dawn Sutherland, VP Finance, & Excellent Team @ XEROX Corporation |

hosted a fabulous

|

| Mary J. Blige singing "No More Drama" |

Karen Earl, and volunteers like the incomparable

Ingrid Roberts and the entire staff of amazing men and women continue the legacy of being each other's keepers.

20 years ago, 5 African American women so truly identified with

Fanny Lou Hammer's words,

"I'm sick and tired of being sick and tired". And these women made a change.

So these 5 women set out to make a difference in the lives of women who had come to realize, as Schinal Walker said during her acceptance speech, "A woman should feel safe in her home."

When Halle Berry introduced Mary J. Blige as the guest performer, we all screamed!

Mary J. Blige, you brought us all to our feet - out of respect and love for you and your amazing voice that carries our emotions in every note.

Photos of Halle Berry Nadia Buari by Rob LaTour

The Two Faces of RIM

I think that's because there are really two BlackBerry customer bases, one in North America, and one in the rest of the world. I wrote about this a year and a half ago (link), but I didn't think about how it related to RIM's earnings situation, and neither did a lot of other people.

To summarize, in North America, where RIM first came to prominence, its products tend to be seen as business tools. They were first adopted by businesspeople who had a strong need for up-to-the-minute communication, including Wall Street traders and government officials. As a result, RIM's image and core customer base in North America has always focused on business professionals. The reality was more mixed; RIM did reach some non-professional users in North America, aided by operator marketing campaigns that included a memorable T-Mobile TV ad that praised the benefits of a BlackBerry flip phone designed to prevent "butt-dialing" (link). But the most popular smartphones for non-business consumers in North America tended to be the Sidekick, and later iPhone and various Android models.

The situation was different in the rest of the world. BlackBerry came to market there later, and people in many countries were not as enamored of real-time e-mail as they were in the US and Canada. In those countries, BlackBerry generally caught on as a low-cost youth messaging phone, aided by RIM's BlackBerry Instant Messenger service, which lets consumers see when their texts have been read. The relatively low parts cost of a BlackBerry compared to other smartphones also helped RIM reach consumer-friendly price points. In some countries, BlackBerry established a strong network effect among young people. If everyone else in your social group has BlackBerry Messenger, you'll be completely left out if you don't use it as well.

As in North America, there are exceptions. You can find business users of the BlackBerry anywhere in the world. But I think it's fair to say that the average person in North America tends to see BlackBerry as a professional business product, while the average person in the rest of the world tends to see BlackBerry as a youth consumer product.

This explains the differing reactions to RIM's announcement. Observers in North America (including me) tended to view it as a long overdue refocusing on RIM's first and most loyal customers. Observers in other parts of the world tended to view it as a thick-headed betrayal of RIM's fastest-growing customer group.

Some of the reactions outside North America were very acerbic. My favorite came from Andrew Orlowski of the Register (link), who noted the irony that RIM had made its announcement "with the English rioting season fast approaching." Yes, he was that upset.

So which group is right? I think they both are; it just depends on which face of RIM you see around you. Both sides of RIM have a core of loyal customers, but both sides also have risks. In North America, I think business users are largely saturated with smartphones, and this is where RIM's business has been losing the most share. On the other hand, these customers produce the highest gross margins when happy, and they are not being targeted heavily by other smartphone companies. In the rest of the world, RIM's base is younger and growing faster than its North American business base, but it's hard to picture BB Messenger competing successfully in the long term against social messaging through sites like Facebook. RIM might be able to maintain BBM as a standard by licensing it to other phone companies, but that would destroy the differentiation of the company's hardware, leaving it to compete on raw price against Android licensees like Samsung and China, Inc. I'd rather walk on razor blades.

So I can easily make a case for focusing on either one market or the other, with the idea being that if you work very hard you can at least hang onto part of your current base, giving you a foundation to grow from in the future. But it's not clear that RIM is ready to make that sort of apocalyptic choice. Instead, it sounds a lot like a company that wants to ride two horses at once.

A small group of observers said Heins' comments about enterprise had been taken out of context, and that it was important to listen to all of RIM's conference call, something that many people apparently didn't do at the time (including me, I am ashamed to say). So I went back and reviewed the full transcript of RIM's call (link), and here's what I think I read:

"We plan to refocus on the enterprise business and capitalize on our leading position in this segment."

RIM did definitely say that it's re-dedicating itself to serving enterprise customers. But I am not clear on whether that means serving IT managers or individual business users (or both). As I mentioned in my previous post, that is a big difference. Individual business-oriented users are a segment; they will not go away. And anyone who thinks those users all want to play games and listen to music on their smartphones is out of touch with reality. But IT as a major channel for smartphone sales is waning. Although focusing on IT might be a good tactic to preserve some short-term revenue, it's not a long-term strategy for the whole company.

"Other products competing in the bring-your-own-device segment is to create a compelling consumer offering. We believe that BlackBerry cannot succeed if we try to be everybody's darling and all things to all people. Therefore, we plan to build on our strengths to go after targeted consumer segments, and we will seek strong partnerships to deliver those consumer features and content that are not central to the BlackBerry valuable position, for example, media consumption applications."

So RIM did say that it's backing away from some investments on the consumer side. But that does not mean it is abandoning its young users. I think Heins is hinting that RIM will focus on messaging phones and use software licensing to give those phones media playback and gaming features. Outsourcing is a typical tactic that tech companies use when in financial trouble. Sometimes outsourcing actually does save you money, and sometimes you find that licensing and integrating the third party software costs you about the same as building it yourself. So I don't know how well that will work out for RIM, but it doesn't necessarily mean they are dumping the consumer market.

"Another key area where we will be making significant change is in our services business. Here, I'm referring specifically to the consumer-oriented, value-added services business that we have attempted to build over the past 2.5 years through numerous various acquisitions....The heavy ongoing investment required to continue this initiative does not make sense given RIM's current market position and our relative strength. As a result, we will be looking at ways to scale back these activities and refocus resources on developing an integrated services offering that leverages RIM's strength, such as BBM, security and manageability."

This is the place where Heins definitely signaled cuts. It sounds ominous for Gist and Tungle and the other mobile web startups RIM bought in the last couple of years. I hope they're not all being thrown out, since I believe they could help to differentiate RIM's products, but recent acquisitions are often at risk in corporate restructurings because they are not viewed as part of the "core product offering." (Just look at what happened to Palm.) Besides, they do not usually have big revenue forecasts attached to them, so they can be cut without forcing a drop in the corporate earnings forecast.

Reading RIM's comments closely, it sounds like they're saying they want to preserve both their business user base in North America and their youth messaging base in the rest of the world. That's sensible from a revenue preservation standpoint, but it means that RIM will continue to be serving two masters with very different needs. Compare that to Apple, which basically makes one smartphone at a time. It will be hard to cut a lot of engineering cost at RIM, and it will be very difficult to create products that please both North America and the rest of the world, especially if RIM tries to add some significant new differentiators. Features that please its North American core are not likely to also please the international market, and price points that would be acceptable in North America will likely be too high for the rest of the world. The danger is that RIM will be like an army fighting on two fronts, with its forces below critical mass on both sides.

For RIM, this is yet another layer of challenge and uncertainty on top of what was already a very challenging situation. Although customers may be glad to hear that RIM's not abandoning either group, to me the two faces of RIM make its situation even more daunting.

Sunday, April 15, 2012

Jenesse Center, Inc., Silver Rose Awards Gala & Auction 2012

The Jenesse Center, Inc., Silver Rose Weekend 2012, started with an Awards Gala & Auction at the Beverly Hills Hotel, in Beverly Hills, CA.

Jenesse Center, Inc., was founded in 1980 by five African American women who were survivors of domestic violence.

Our Mission -

"To provide victims of domestic violence with a comprehensive, centralized base of support to assist them in addressing their immediate crisis and changing the patterns of their lives."

This year's Honorees were:

XEROX Corporation, Paula Williams Madison, Ingrid Roberts, and Schinal Walker, whose compelling story can bring one to tears. Schinal Walker is a resilient, woman, whose only recourse was to seek help. Her friends, the beautiful Actress, Jurnee Smollett and her sister, Jazz Smollett, who are both very active on screen and in the community, told Schinal to choose safety.

These two sisters, Jurnee and Jazz Smollett, have hearts of gold, and have been there for Schinal Walker from day one.

Tomorrow, Monday, April 16, 2012, is the Halle Berry Celebrity Golf Classic Auction & Awards Dinner at the Wilshire Country Club, Los Angles, CA. This wraps up a fabulous weekend of so many people of all walks of life, supporting Jenesse Center, which provides "a peaceful night's sleep and a new beginning" for those women and children who have been living in unsafe environments.

Speaking of Halle Berry, she looks fabulous! Halle is the Chair of the Silver Rose Awards Gala and Auction.

Halle Berry was such a gracious Host and she lovingly embraced fellow Actress, Nadia Buari,

of Ghana. Nadia has starred in 35 + films in West Africa. (Nadia Buari's Publicist in USA - Carla Thomas)

There's more to come....Smooches, Carla

|

| Actress Nadia Buari, Ghana Came out to Support Jenesse Center, Inc. |

|

| Dawn Sutherland, VP of Finance, USCO Southern, CA/ Las Vegas Ops, Xerox Corporation |

Tuesday, April 10, 2012

April Quick Escapes in Beverly Hills ~

This leads one to almost believe that

This leads one to almost believe that Southern California is in the midst of summer already!

If you need an escape and can't get away,

may I suggest that you stop on over to the

Beverly Canon Gardens?

The lovely Montage BH Hotel is a cat's paw step away, so after you leave the Beverly Canon Gardens, go on in and visit the many shops and the beautiful Spa Montage, located within your reach....

Did I mention that Chef Scott Conant's Scarpetta Beverly Hills is located @ Montage Beverly Hills? Scarpetta Beverly Hills features some of the most Soulful Italian food that you'll ever taste -

umph, umph, umph, I am not mad at Chef Scott Conant for doing his thing in the kitchen!

(They're open most nights until 11:00pm..).

The Montage Beverly Hills has so many really good packages, check them out...

Yes, I really think that you and yours, should check into the Montage Beverly Hills and call it a day, okay?

We've been spending more time out at the beach.

The Pacific Ocean is truly awesome!(Don't take it for granted!)

|

| Riviera, just below Palos Verdes, CA |

Smooches,

C

(Montage Beverly Hills 225 N. Canon Drive, Beverly Hills, CA 90210| 310.860.7800 ~ Scarpetta BH 310.860.7970)

Monday, April 9, 2012

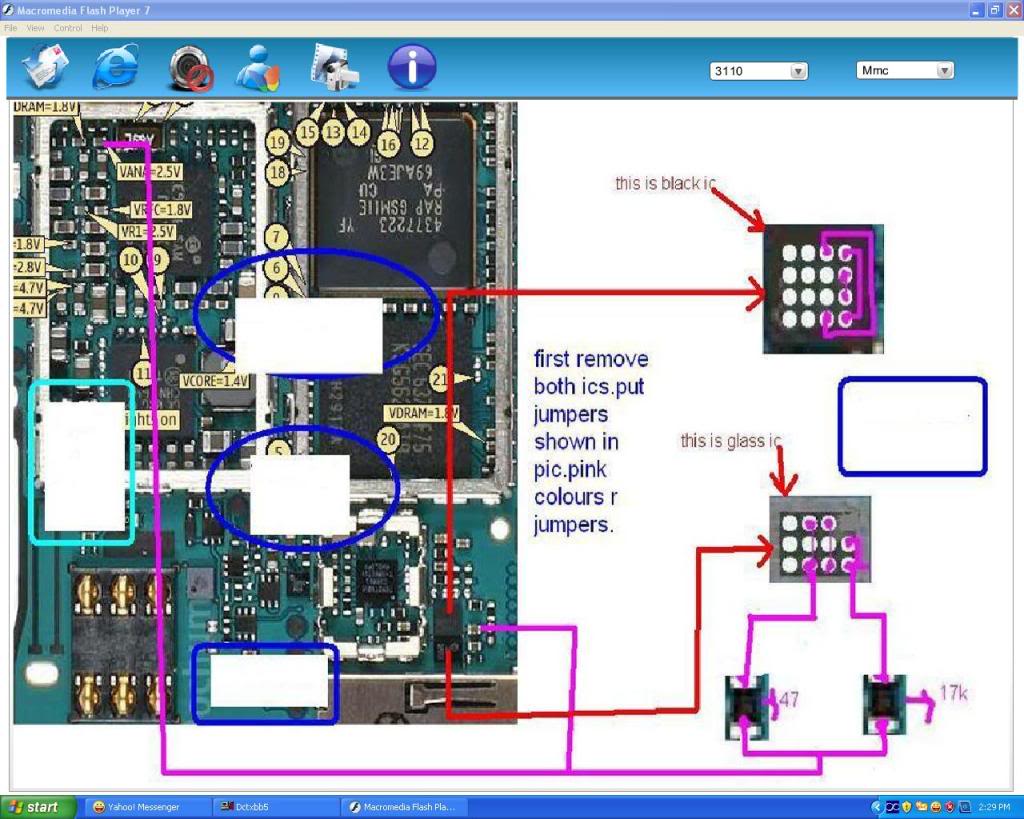

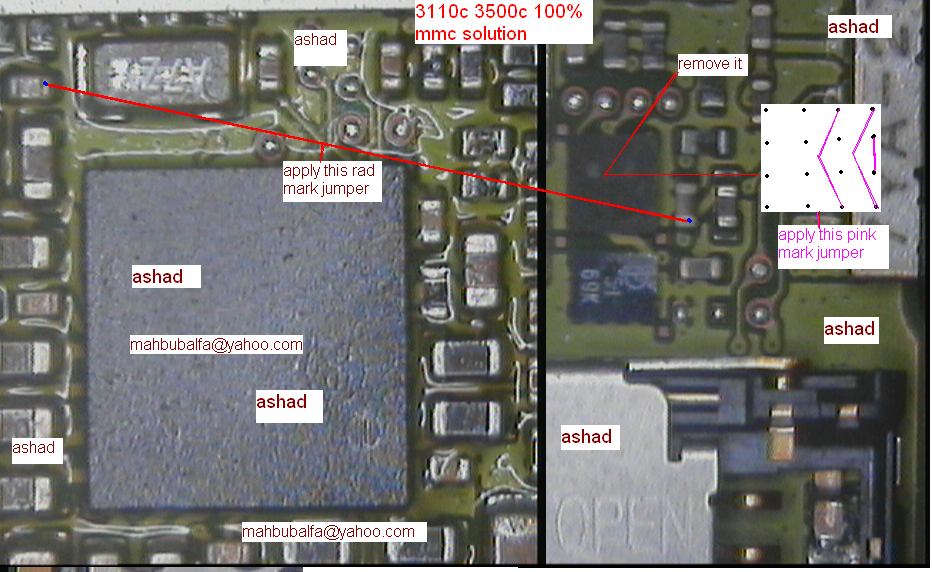

Nokia 3110c Memory card problem solution.

This post holds Nokia 3110c Memory Card Problem. If you are having one of these problems check these images out and do these simple solutions.

- 3110c No memory Card Found Problem

- 3110c Memory card Not formatted Problem

- 3110c MMC Card IC Jumper Ways

- 3110c Memory Card Corrupted Ways

- 3110c Insert mmc card Jumpers

Here Are The Solutions. Please Observe Carefully.

If you have further Questions please don’t hesitate to leave a comment.

Nokia 3110c Ringer Buzzer Ways Problem

This post holds Nokia 3110c Ringer Buzzer Ways Problem. If you are having one of these problems check these images out and do these simple solutions.

- 3110c Ringer Problem

- 3110c Buzzer Problem

- 3110c Ringer Ways

- 3110c Buzzer Ways

- 3110c Ringer Jumpers

- 3110c Buzzer Jumpers

Here Are The Solutions. Please Observe Carefully.

3110c buzzer ringer ways 1

3110c buzzer ringer ways 2

If you have further Questions please don’t hesitate to leave a comment.

Nokia 3110c Earpiece Speaker Ways Problem.

This post holds Nokia 3110c Earpiece Speaker Ways Problem. If you are having one of these problems check these images out and do these simple solutions.

- 3110c Speaker Problem

- 3110c Speaker Ways

- 3110c Speaker Jumpers

- 3110c earpiece Problem

- 3110c earpiece ways

- 3110c earpiece jumpers

Here Are The Solutions. Please Observe Carefully.

3110c Speaker earphone Ways 1

3110c Speaker earphone Ways 2

If you have further Questions please don’t hesitate to leave a comment.

Nokia 3110c Not Charging Problem solution.

This post holds Nokia Nokia 3110c Not Charging Problem. If you are having one of these problems check these images out and do these simple solutions.

- 3110c Not Charging

- 3110c Charging Problem

- 3110c Charging Ways

- 3110c Charging Jumpers

- 3110c Charging Solutions

Here Are The Solutions. Please Observe Carefully.

3110c Not Charging Problem 1

3110c Not Charging Problem 2

3110c Not Charging Problem 3

3110c Not Charging Problem 4

If you have further Questions please don’t hesitate to leave a comment.

Nokia 3110c Power Button On/Off Switch Ways.

This post holds Nokia 3110c Power Button On/Off Switch Ways. If you are having one of these problems check these images out and do these simple solutions.

- 3110c Power Button Ways

- 3110c Power Switch Ways

- 3110c Power Button Problem

- 3110c On/Off Button Ways

- 3110c On/Off Switch Ways

- 3110c On/Off Switch Problem

Here Are The Solutions. Please Observe Carefully.

3110c Power Button On Off Switch Ways

3110c Power Button On/Off Switch Ways

If you have further Questions please don’t hesitate to leave a comment.

Nokia 3110c Mic Microphone ways Problem

This post holds Nokia 3110c Mic Microphone ways Problem. If you are having one of these problems check these images out and do these simple solutions.

- 3110c Mic Problem

- 3110c Mic Ways

- 3110c Mic Jumpers

- 3110c Microphone Ways

- 3110c Microphone Problem

- 3110c Microphone Jumpers

Here Are The Solutions. Please Observe Carefully.

3110C microphone ways 1

3110C microphone ways 2

3110C microphone ways 3

3110C microphone ways 4

If you have further Questions please don’t hesitate to leave a comment.

Nokia 3110c Keypad Ways Problem

This post holds Nokia 3110c Keypad Ways Problem. If you are having one of these problems check these images out and do these simple solutions.

- 3110c Keypad Ways

- 3110c Keypad Problem

- 3110c Keypad Not working

- 3110c Keypad Jumpers

- 3110c Keypad Tracks

- 3110c Keypad Links

Here Are The Solutions. Please Observe Carefully.

3110c Keypad Ways Problem 1

3110c Keypad Ways Problem 2

If you have further Questions please don’t hesitate to leave a comment.

Nokia 3110c Lcd Display Back Light Problem Solution.

This post holds Nokia 3110c Lcd Display Backlight Problem. If you are having one of these problems check these images out and do these simple solutions.

- 3110c Lcd Back Llight Problem

- 3110 Display Light Problem

- 3110c No Light

- 3110c No Lcd Light

- 3110c Lcd Led Lights Problem

- 3110c Keypad Led Problem

Here Are The Solutions. Please Observe Carefully.

3110c lcd backlight problem 1

3110c Lcd Backlight Problem

If you have further Questions please don’t hesitate to leave a comment.

Nokia 3110c Insert Sim Card Problem Solution.

This post holds Nokia 3110c Insert Sim Card Problem. If you are having one of these problems check these images out and do these simple solutions.

- 3110c Insert Sim Card

- 3110c Sim Problem

- 3110c Sim Ways

- 3110c Sim Jacket Jumpers

- 3110c Sim Base Tracks

- 3110c Sim Card Problem

Here Are The Solutions. Please Observe Carefully.

3110c Insert Sim Card Problem 1

If you have further Questions please don’t hesitate to leave a comment.

Nokia 3110c No Display Lcd Problem Solution.

This post holds Nokia 3110c No Display Lcd Problem. If you are having one of these problems check these images out and do these simple solutions.

- 3110c Lcd Problem

- 3110c Display Problme

- 3110c No Display

- 3110c No Lcd

- 3110c Lcd Ways

- 3110c Display Ic jumpers

- 3110c Lcd Jumpers

Here Are The Solutions. Please Observe Carefully.

3110c No Display Lcd Problem 1

3110c No Display Lcd Problem 2

3110c No Display Lcd Problem 3

3110c No Display Lcd Problem 4

If you have further Questions please don’t hesitate to leave a comment.

Nokia 3110c Contact Service Problem solution.

This post holds Nokia 3110c Contact Service Problem. If you are having one of these problems check these images out and do these simple solutions.

- 3110c Contact Service Problem

- 3110c Contact Service

- 3110c Flashing Problem

- 3110c Hang Problem

- 3110c Pm Files Download

- 3110c Contact Service Solution

Firt Of All Do These Steps:

- Flash Your Phone

- Do Full Unlock

- Write Good PM

- Unlock Again

Download Full 3110c PM File

If the problem remains do these solutions:

Here Are The Solutions. Please Observe Carefully.

3110c Contact Service Problem

If you have further Questions please don’t hesitate to leave a comment.

Nokia 3110c No Network Problem solution.

This post holds Nokia 3110c No Network Problem. If you are having one of these problems check these images out and do these simple solutions.

- 3110c Network Problem

- 3110c No Network

- 3110c No Network Problem

- 3110c Network Solution

- 3110c No Network Ways

Here Are The Solutions. Please Observe Carefully.

3110c No Network Problem 1

3110c No Network Problem 2

3110c No Network Problem 3

3110c No Network Problem 4

If you have further Questions please don’t hesitate to leave a comment.

Nokia 3110c Local Test Mode Problem Solution.

This post holds Nokia 3110c Local Test Mode Problem. If you are having one of these problems check these images out and do these simple solutions.

- 3110c Local Mode Problem

- 3110c Test Mode Problem

- 3110c Hang In Test Mode

- 3110c Hang In Local Mode

- 3110c Test Mode Activated

- 3110c Local Mode Activated

Here Are The Solutions. Please Observe Carefully.

3110c Local Test Mode Problem

If you have further Questions please don’t hesitate to leave a comment.

Friday, April 6, 2012

Mario Canali's Art Exhibit @ DAC Gallery - Amazing!

Get on over to DAC Gallery, (828 S. Main Street, LA, CA 90014)

and see Mario Canali's Art Exhibit, which is closing today.

You will love it!

Happy Passover/Easter to you and yours - Smooches, C

Monday, April 2, 2012

Rebuilding RIM

"RIM weighs bleak options," says the Wall Street journal (link). The article quotes a customer as saying a recent meeting with RIM officials was "like going to a wake."

But the reality is that RIM's future is not yet decided. Definitely the odds are against it. But well-known brands have an amazing ability to come back; people are almost always willing to give them another chance. (Check the history of Packard Bell, a 1920s radio brand that came back as a 1980s computer brand. Heck, you could probably revive Palm if HP took its cold dead hands off the thing.) RIM's fate depends on a huge number of unpredictable details, some of which haven't even happened yet, and others that we don't know because we're not company insiders.

So we can't predict what will happen to RIM, but we can talk about what the company needs to do to survive. If nothing else it's an interesting case study for anyone who needs to turn around a tech company.

Step one: Acknowledge the problem in public

One of the smartest marketing people I ever worked with is Christopher Escher. He was at Apple for a long time, and then served in the early days at Google. Chris said that the process of rehabilitating a company's image was like moving the hands of a clock. Having a great image was at 12:00. A company's image could stay in that position for a long time as long as it didn't have too much bad news. But if bad news built up, the hands eventually slipped over to the 3:00 position, which meant you were perceived to be a troubled company.

Chris said companies always want to force the hands to go backwards to 12, because they want to get past the pain. But his insight was that you can never do that. First you have to acknowledge the problem (3 pm), articulate your plan (6 pm), and then show that you're making progress at fixing it (9 pm). I think Chris had some other stages in there, but you get the general idea. Only after you had taken all of the intermediate steps, and posted improved financials as a result, would people believe that you had actually earned your redemption and returned to stability at 12.

The business redemption clock, a concept by Christopher Escher.

A good example of this process in action was Stephen Elop's moves at Nokia after he became CEO. The notorious "burning platform" memo, which I believe was deliberately leaked, acknowledged the problems at Nokia and made its later moves much more credible to the press and analysts. That doesn't mean Elop made the right moves, or that they will work, but if he had denied there was a problem, people would not have even paid attention to his later moves.

Until its earnings announcement last week, RIM was still trying to make the clock hands go back to 12, and it wasn't working. All it did was convince people that management was out of touch. When RIM acknowledged the depth of the problem, suddenly the tone changed in some of the coverage. "RIM finally seems to get it," CNET declared (link).

There is a downside to acknowledging the problem: you make it worse. Remember the despair and disbelief that "burning platform" created among Nokia fans (link). You frighten any customers who aren't already worried, and partners may delay or cancel their work with you. As you'll see, this is a problem with many of the steps you have to take to fix a broken tech company -- the medicine makes you even sicker at first.

Step two: Focus

Almost by definition, a troubled tech company will be trying to create too many products and funding too many business initiatives, the leftovers from more optimistic times. There isn't enough revenue to pay for all of them, so you have to eliminate some. This is an agonizing process. Usually there is current or forecasted revenue tied to every project (not enough revenue, but some). So when you cut them, you don't just lower your expenses, you also reduce further your expected revenue. That forces you to cut even more.

Companies often default to keeping their most profitable product lines, because that requires the smallest cuts. "We're focusing on the core," the executives say. But usually the most profitable product lines are the oldest ones with the worst growth prospects. Focus on them and you'll lock the company into an irreversible decline.

The right way to focus is to plan from the bottom up. Decide what you want the company to be, who the target customers are, and what special value you'll deliver to them. Fund the projects that support that goal. Everything else, no matter how valuable or emotionally important, is a candidate to be cut. If those cuts don't reduce your expenses enough, revisit the goal and make it even more tightly focused, allowing you to kill more things.

This process forces you to slaughter sacred cows. Steve Jobs returns to Apple, and decides the company will focus on making Macs for creative people. Out goes Newton, out goes twenty years of painfully-assembled enterprise sales infrastructure, out goes the printer business. Lou Gerstner decides IBM will be a services company; he kills OS/2, pulls its PCs out of retail, and preps that business for sale.

RIM's focus is questionable at this point. Thorsten Heins appeared to be very focused when said that RIM would "refocus on the enterprise business" because "BlackBerry cannot succeed if we tried to be everybody’s darling and all things to all people." But the next day two RIM executives denied that the company was exiting the consumer market (link).

One of three things happened. Either:

--Heins' remarks were remarkably badly scripted, and the company really doesn't plan to back away from the consumer market. This would be a bad sign for the company's ability to execute. How in the world could you botch a critical message like that in an important earnings call? Get your act together. Or:

--Heins really does plan to back away from the consumer market, but some others in the company are in denial about it and are trying to spin-doctor him. This is unlikely since two executives delivered the same correction. But I've seen weirder things happen. Or:

--RIM plans to exit the consumer market but doesn't want to say so yet because it needs to sell all of its current products that are still in inventory. I suspect that's the reality. Shamefully sloppy marketing by RIM if tghey raised this issue without understanding the impact it would have on sales. RIM needs to be crisper if it is to survive.

Messaging aside, the impact of a RIM focus on enterprise depends on your definition of "enterprise." If RIM is planning to focus on top-down corporate sales through IT managers, good luck and goodbye. The long-term trend is that IT has less and less control over the mobile device choices of users in the company, so RIM would be tying itself to a dying sales channel. But if by "enterprise" RIM means it will focus on the needs of individual businesspeople rather than entertainment-hungry teenagers, that is RIM's best prospect for getting reasonable margins, and probably its best chance to survive.

Some of the diversity of reactions to Heins' remarks has been driven by commentators making different assumptions about the definition of "enterprise." Roger Cheng at CNET assumed it meant business end-users, and praised the change. On the other hand, Horace Dediu assumed it meant selling through IT managers, and was utterly dismissive (link).

The important question is what Thorsten Heins meant, and we don't know the answer to that.

Step three: Get a win

The next step is to hold onto your installed base. This is important for any device company, because your loyal customers are the nucleus from which you'll grow in the future. No one else is going to hang out with you right now because you're damaged goods. The base is especially important for RIM because they're paying monthly service fees to the company. That high-margin revenue stream is critical to RIM's recovery, and must be maintained. I was encouraged that even amidst all the bad news RIM still grew its subscriber base slightly last quarter. I doubt that will continue, but if RIM can keep the base close to even, it'll help a lot with the future transitions.

This may be why the company was so sensitive to the idea that it would "abandon" consumers. It's not the right time to send that message to the public, even if it is true.

Instead, you need to lavish love on the installed base. That means giving them special discounts for buying a new BlackBerry, telling them how important they are, and getting them excited about the product's future. They have heard those promises before, though, so to make it credible RIM needs some nice, solid new products.

I'm not saying killer products. Those would be great, but since RIM was dysfunctional, I doubt there are killers in the pipeline. At this point, it would be enough to ship a couple of very solid, well executed devices that deliver on RIM's expected value and don't crash. Think of the role that the iMac played in Apple's recovery. The device itself wasn't all that spectacular, but it was iconically Apple, and proved that the company was reconnecting with its values. It engaged loyal Mac users emotionally, gave them a reason to believe, and put Apple back in the game.

So Heins should look at the devices in RIM's pipeline for the next six months, and focus everyone on implementing the few that look most promising on the core BlackBerry values of reliability, convenience, and great messaging. Stop work on everything else. It's better to have one or two wins than four mediocre products. And stop producing a slightly different model for every mobile operator. You can't execute well on that complexity; it's part of what got you in trouble.

Will this lose you some operators? Yes it will, but it's better to have a smaller channel that is enthusiastic about your products than an overstocked channel that doesn't care. (Again, look at the way Apple trimmed dealerships when it was working on its comeback.)

Step four: Create differentiation

Now you've focused the company and momentarily stabilized the installed base, or at least slowed its bleeding. Next you need to add a few differentiators -- unique features that do things your customers will love and will drive them to come into stores and demand your products. Create no more than three of these features. You can't effectively advertise more than three anyway, so it's better to do three really well than to have six that kind of mostly work.

If you get these features right, your target customers will forgive dozens of other flaws in order to obtain the value of your differentiators. This is what gets you off the hook for copying every feature of the iPhone, which you can't afford to do and won't implement well anyway (case in point, RIM's product history for the last several years).

What are those features? I have some ideas, but a lot depends on which technologies RIM has in house and how talented its engineers and product managers are. There are plenty of important unsolved problems RIM can tackle for businesspeople on the go. Things like meeting planning, managing e-mails and text messages while you're driving, and finding parking in a crowded city might all benefit from RIM's integrated client-server architecture. There are also plenty of opportunities to integrate BlackBerry uniquely with business infrastructure. BlackBerry was first successful because it integrated so reliably with Microsoft Outlook and Exchange. What could RIM accomplish if it applied that same sort of focus to Salesforce.com or Dropbox or LinkedIn?

RIM has the pieces to build some of these solutions -- it has bought a number of startups like contact manager Gist and calendar manager Tungle. I hope those are being viewed as part of the solution rather than random acquisitions that now need to be tossed out.

You'll notice that I'm not saying anything about BlackBerry OS 10. That's because it almost certainly can't be a differentiator, for several reasons:

--The first release of an OS is almost always focused on just making the basics work properly. If BlackBerry 10 is stable and doesn't crash, that is probably the most you can expect from it. Maybe OS 10 will let RIM announce that its phones now suck less, but that's not a differentiator, that's table stakes.

--Until very recently, RIM's main explanation for why it needed BlackBerry 10 was so it could match the multimedia and entertainment features of iOS. If that has been the development focus, it's very unlikely that the OS has a lot to offer to businesspeople in its first version.

--The average customer does not buy an operating system. In the tech industry, we pay a lot of attention to operating systems because we know they are important enabling technologies. But what customers respond to is the features they enable. When is the last time you heard someone say they bought a mobile phone because its OS did a better job of paging memory or scheduling symmetric multiprocessing?

What about the idea of RIM licensing out its operating system? Forget about it. First of all, I doubt there are any customers. But even if they are, the distraction of serving the different demands of various licensees would tear the OS team apart. RIM just doesn't have the money and staff to make this work. Its best play is to deeply integrate its OS, devices, and services to create unique systems. That sort of stuff is hard for Android to copy, and challenging even to Apple.

So those are the four steps: Acknowledge the problem, focus (and cut brutally), find a quick win, and create differentiation. Each step sounds fairly straightforward, but the hard part is that you have to get them all right, and you have to do them fast. It's like doing brain surgery on yourself while driving your car down the freeway at 60 miles a hour. Any mistake can be fatal.

The most difficult steps are the third and fourth, finding a quick product win and creating differentiation. Typically a major new product or differentiator takes 18 months to implement, even if you're moving fast. I think RIM probably has six months to roll out a product win, and at most 12 months to show some major new differentiators. Go beyond that, and the installed base may be draining away faster than you can refill it. When Steve Jobs returned to Apple, he was lucky that the industrial design team that created the iMac was already in place. We'd better hope there are some great half-completed projects in the labs at RIM that Heins can focus the team on.

What to watch. It's because of uncertainties like this that no one can predict if RIM will survive. But there is a metric we can watch to assess the company's chances: cash. Cash to a device company is like altitude to an airplane. When a device company fails, it's usually because it runs out of the cash it needs to build inventory and advertise a new product release. RIM currently has about $1.8 billion in easily-available cash, down about $300 million from a year ago. Net income was $1.1 billion. For comparison, in 1997 Apple lost $1 billion and had $1.5 billion in cash left. Eighteen more months and it would have been dead.

So RIM is not as acutely sick today as Apple was in 1997. But the BlackBerry base is not as loyal as the Mac base was, and Thorsten Heins isn't Steve Jobs. The danger to RIM isn't an instant collapse, it's an accelerating decline into irrelevance. That decline may already be irreversible. If it isn't, RIM needs to act urgently to turn it around. Acknowledging the problem is a good (if belated) start, but the hard work is still to be done.